Mumbai, Dec 06: Birla Institute of Management Technology (BIMTECH), Greater Noida — one of India’s leading AACSB-accredited business schools successfully concluded its monthly CEO/CXO Talk series, “A Conversation with Gen Z.” The initiative brought top business leaders to campus to share insights on leadership, HR strategies, and digital transformation with aspiring young managers.

The speaker lineup included Kenji Inoue, CFO & COO, UNIQLO India; Swarup Mohanty, Vice Chairman & CEO, Mirae Asset Investment Managers (India) Pvt. Ltd.; Abhay Batra, Co-Founder & CFO, Clovia; and Vijay Ranjan Singh, HR Head, LG India. Subsequent sessions also featured Seepika Singhal, Senior Director & Global Head Total Rewards, Brillio Technologies; Rahul Vij, COO, Digi Haat (Nirmit Bharat); and Aditya Agarwal, Executive Vice President Digital, Maruti Suzuki India Ltd., each delivering impactful individual interactions with students.

These sessions provided students with actionable perspectives on leadership, digital acceleration, investment journeys, and talent management — reinforcing BIMTECH’s commitment to strengthening industry–academia collaboration.

During his talk, Mr. Swarup Mohanty shared an important personal learning, stating:

“I made two mistakes not starting to invest early and not remaining invested. I thought I was smarter than the markets, but soon realized that the markets are always smarter. In a country like India, which is poised for exponential growth, investing in capital markets is one of the most meaningful ways to participate in its progress.”

The interactive format encouraged students to participate in conversations around entrepreneurship, brand positioning, and product innovation. Mr. Abhay Batra emphasized the power of mindful marketing strategies, remarking:

“Spending a lot of money doesn’t ensure success. What works is organic connection and doing things the right way.”

He concluded with an inspiring message for future leaders:

“The only difference between success and no success is doing.”

Bringing high energy to the session, Mr. Vijay Ranjan Singh urged students to reflect on their aspirations and readiness for the corporate world. Quoting the film Sultan, he highlighted the importance of self-driven growth, adding:

“You can only defeat yourself.”

BIMTECH’s Vision: Industry-Ready Leaders for the Future

BIMTECH stands among the few B-schools in India with a structured year-round CEO/CXO talk series designed to develop industry-centric thinking, professional preparedness, and future leadership capabilities. The initiative also invites corporate leaders to contribute their experiences for the benefit of emerging talent, strengthening the larger ecosystem of future managers in India.

As a pioneering institution, BIMTECH continues to raise the bar through initiatives such as:

-

Launch of the Bloomberg Lab, Marketing & Retail Research Lab, and BIMCOIN a blockchain-based campus currency

-

A strategic partnership with UNIQLO

-

Students winning the PRME Global Students Sustainability Award 2025 at the United Nations Headquarters, New York

-

Support extended to 150+ startups during the Google AI Startup Day

-

Workshops like Train-the-Trainer for Inclusive Higher Education by BCall (Centre of Education for All)

Inspired by its visionary founders Late Basant Kumar Birla and Sarala Birla, BIMTECH offers programs including PGDM, PGDM (International Business), PGDM (Insurance Business Management), PGDM (Retail Management), PGDM Online, and FPM/E-FPM — shaping ethical, globally competent business leaders. Supported by a strong alumni network of over 8,000 professionals, BIMTECH continues to hold its position among globally recognized management institutions.

Mumbai/ Kolkata, Dec 06th: The 54th ITC Sangeet Sammelan 2025, presented by the ITC Sangeet Research Academy (ITC SRA) from 5th to 7th December, commenced with an overwhelming participation, drawing connoisseurs, music lovers and people from all walks of life from across India. Held on the Academy’s picturesque lawns, the inaugural session of the three-day festival showcased the depth, diversity and richness of Indian classical music, an artistic heritage ITC SRA has upheld for nearly five decades.

Mumbai/ Kolkata, Dec 06th: The 54th ITC Sangeet Sammelan 2025, presented by the ITC Sangeet Research Academy (ITC SRA) from 5th to 7th December, commenced with an overwhelming participation, drawing connoisseurs, music lovers and people from all walks of life from across India. Held on the Academy’s picturesque lawns, the inaugural session of the three-day festival showcased the depth, diversity and richness of Indian classical music, an artistic heritage ITC SRA has upheld for nearly five decades.

Bengaluru, Dec 05th: Škoda Auto India has inaugurated three new Customer Touchpoints in Karnataka, further strengthening its network presence in the state and the southern region of India. These new touchpoints, launched in partnership with Karr Motor Ventures Pvt. Ltd., include two new showrooms at JP Nagar and Magadi Road, along with a new aftersales facility in Bannerghatta Road in Bengaluru, Karnataka.

Bengaluru, Dec 05th: Škoda Auto India has inaugurated three new Customer Touchpoints in Karnataka, further strengthening its network presence in the state and the southern region of India. These new touchpoints, launched in partnership with Karr Motor Ventures Pvt. Ltd., include two new showrooms at JP Nagar and Magadi Road, along with a new aftersales facility in Bannerghatta Road in Bengaluru, Karnataka.

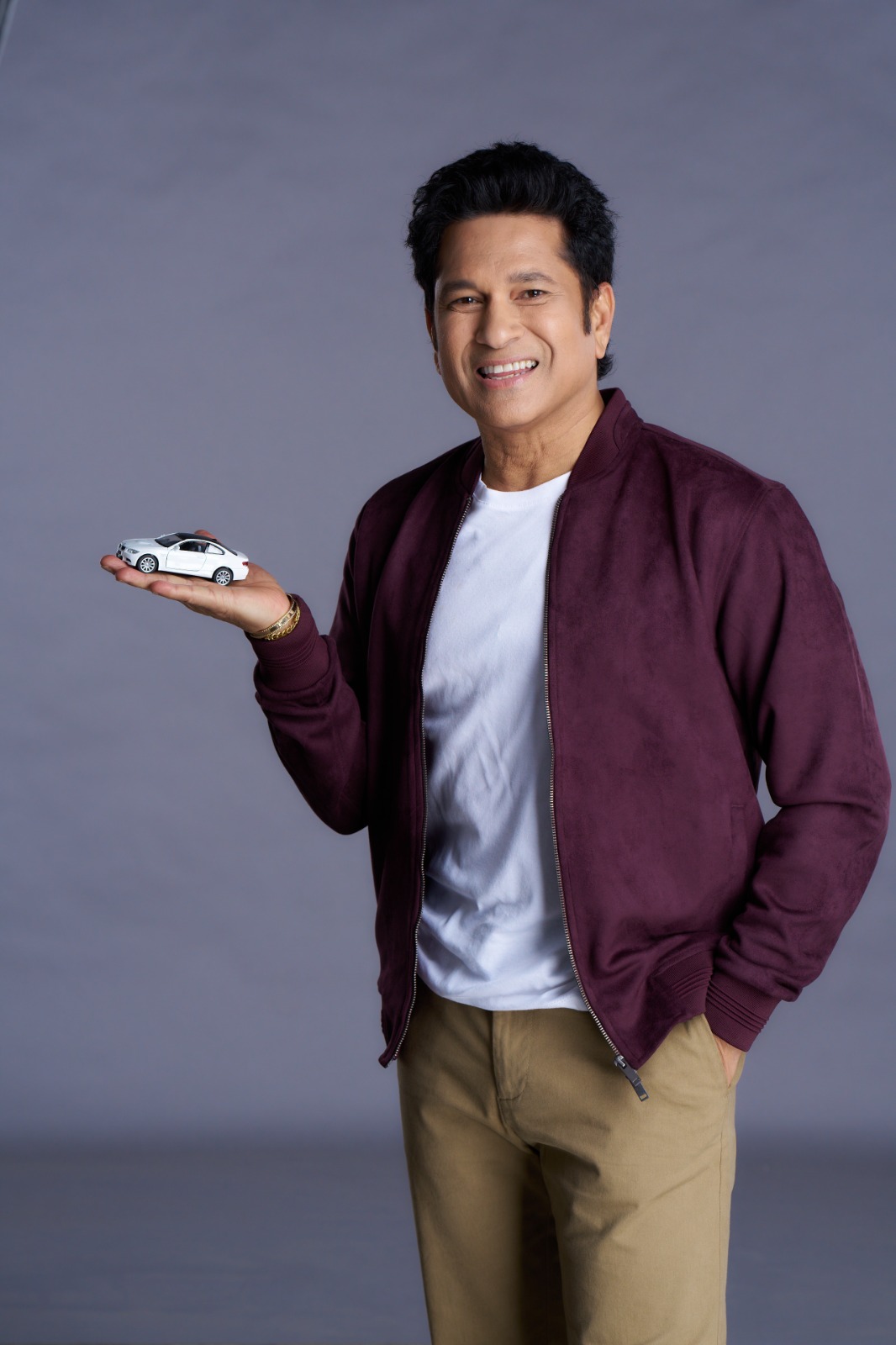

Chandigarh, Dec 05th: Bank of Baroda (Bank), one of India’s leading public sector banks, today announced the launch of its latest advertising campaign featuring its global brand ambassador, Sachin Tendulkar. Building on the success of last year’s ‘Play The Masterstroke’ platform, the new campaign highlights the importance of making the right choices when pursuing life’s major goals – from buying a dream home or car to investing in one’s business. The campaign underscores that choosing the right financial partner is the true Masterstroke that helps turn aspirations into reality.

Chandigarh, Dec 05th: Bank of Baroda (Bank), one of India’s leading public sector banks, today announced the launch of its latest advertising campaign featuring its global brand ambassador, Sachin Tendulkar. Building on the success of last year’s ‘Play The Masterstroke’ platform, the new campaign highlights the importance of making the right choices when pursuing life’s major goals – from buying a dream home or car to investing in one’s business. The campaign underscores that choosing the right financial partner is the true Masterstroke that helps turn aspirations into reality.  Shree Cement, one of India’s leading cement manufacturers, has launched its premium product, Bangur Marble Cement, under its master brand, Bangur Cement in Odisha region. This PSC cement offers best-in-segment brightness, superior strength and crack resistance, making it ideal for exposed concrete structures and ensuring grand, imposing designs. It is also well suited for the weather conditions of coastal Odisha, making it one of the most suitable cement options for the region’s construction needs.

Shree Cement, one of India’s leading cement manufacturers, has launched its premium product, Bangur Marble Cement, under its master brand, Bangur Cement in Odisha region. This PSC cement offers best-in-segment brightness, superior strength and crack resistance, making it ideal for exposed concrete structures and ensuring grand, imposing designs. It is also well suited for the weather conditions of coastal Odisha, making it one of the most suitable cement options for the region’s construction needs.