Mumbai, August 14, 2024: One Point One Solutions, a leader in next-generation Business Process Management (BPM) services, has announced its financial results for the first quarter ending June 30, 2024, demonstrating exceptional performance across key financial indicators.

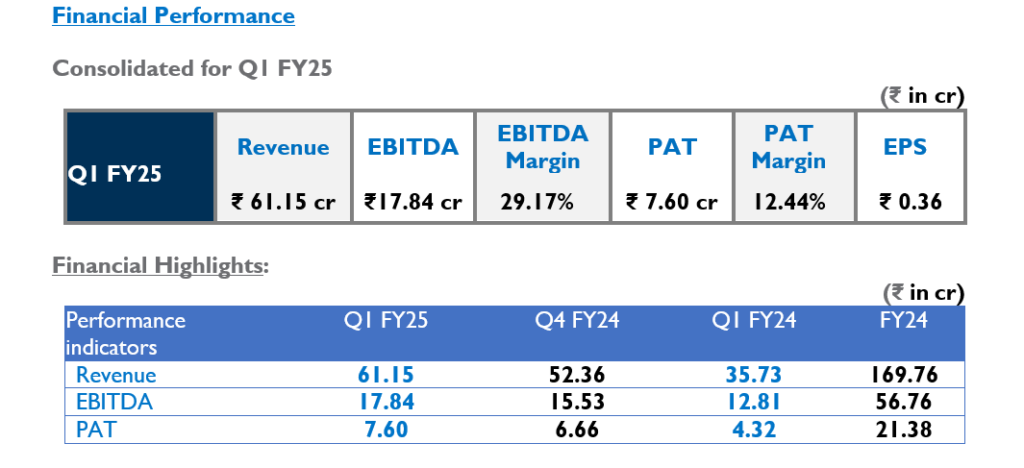

• Revenue: Grew to ₹61.15 crore in Q1 FY25 from ₹52.36 crore in Q4 FY24, marking a 16.79% sequential growth and a substantial 71.12% year-on-year increase from ₹35.73 crore in Q1 FY24.

• EBITDA: Increased to ₹17.84 crore in Q1 FY25, up from ₹15.53 crore in Q4 FY24, representing a 14.87% growth and a 39.27% rise compared to ₹12.81 crore in Q1 FY24.

• PAT: Rose to ₹7.60 crore in Q1 FY25, up from ₹6.66 crore in Q4 FY24, reflecting a 14.13% sequential increase and a 75.93% year-on-year growth from ₹4.32 crore in Q1 FY24.

Business Highlights:

• Increased the authorised share capital from Rs 50 crore to Rs 70 crore and an issuance of equity shares and warrants

• Signed a non-binding term sheet to purchase 100% stake in a BPO firm in Latin America

• Secured a strategic client win with a pioneering medical device company based in Tampa, Florida, USA

• New clients signed include, one of India’s largest integrated power companies and a leading NBFC, dedicated to providing customer centric financial solutions

• One Point One Solutions Limited (OPOSL) subsidiary, ITCube Solutions won a prominent global client specialising in combatting brand threats through cutting-edge AI-driven tools

Management Comment:

Commenting on the results, Mr. Akshay Chhabra, Managing Director said:

“We are thrilled to report a record-breaking start to FY25, with exceptional growth in revenue, EBITDA, and PAT. This performance is a testament to our unwavering commitment to delivering value to our clients through cutting-edge BPM solutions and a strategic focus on operational efficiency. The strong momentum from this quarter provides a solid foundation for sustained growth throughout the year.”

Mr. Chhabra added, “Our efforts in business transformation, leveraging Generative AI and Robotic Process Automation (RPA), are beginning to yield significant results. We are particularly excited about our first acquisition this year, which strengthens our presence in the North American market. This strategic move will accelerate our growth in the American region and adds new verticals in healthcare, finance & accounting, and IT software development, positioning us as a full-stack player in the industry. We remain confident in our ability to continue driving substantial value for our shareholders while expanding our leadership in the BPM sector.”

The Financial results for the quarter ended June 30, 2024 are available in the Investor Relations section of our website www.1point1.com

About One Point One Solutions Ltd.

One Point One Solutions Ltd is a full-stack solutions provider across BPO, KPO, IT Services, Technology & Transformation and Analytics. Over the last two decades, the company has established its expertise in offering comprehensive solutions across technology, accounting, skill development and analysis to clients in a wide variety of sectors. Following the recent acquisition of- ITCube Solutions Pvt Limited, One Point One Solutions has consolidated its solutions in the IT, BPM and KPO domains. The company now has centres in Pune and Cincinnati, Ohio apart from its existing ones in Navi Mumbai, Gurgaon, Chennai, Bangalore, Indore and Pune. One Point One USA Inc, the organization’s wholly-owned subsidiary in Delaware in the United States marks its international foray while in the acquisition of ITCube Solutions has already strengthened its presence in England, Netherlands, Germany, Kuwait Oman m UAE, Qatar, India, Singapore and Australia, apart from the USA.

Led by Founder-Chairman Akshay Chhabra, the company serves a broad spectrum of industries including Banking and Finance, Retail and E-commerce, Consumer Durables & FMCG, Travel & Hospitality, and Insurance & Healthcare. A 5600+ strong team focused on providing efficient services caters to the company’s growing clientele.

The company’s services include Organisations, Customer Services, Sales, Collections, Construction Bid Management, Medical Record Retrieval and Summarization, Tech Helpdesk, BackOffice, Accounting, Litigation, Recruitment, Design and Development among others. By leveraging next-gen technologies including GenAI and intelligent automation, the organisation has been able to develop and deploy innovative solutions that have delivered considerable value to the company’s 50+ clients.